Cash flow is like your daily hit of caffeine. You don’t really notice how important it is for your business until you’ve got to try and operate without it. Today we’ll look at how the recently expanded instant asset write-off initiative can help out in that area.

Review Your Energy Costs and Save up to 20%

Have you reviewed your annual energy costs? Now, more than ever, it is easy to compare energy costs from a range of energy suppliers, and save up to 20% off your bill.

With home loan interest rates dropping, is it time to pull the cord?

Fixing your home loan while rates are dropping is a bit like pulling the ripcord on a parachute. If you do it early you’ll get a steady ride but may miss out on a bit of action. But if you leave it too late things might get a little messy.

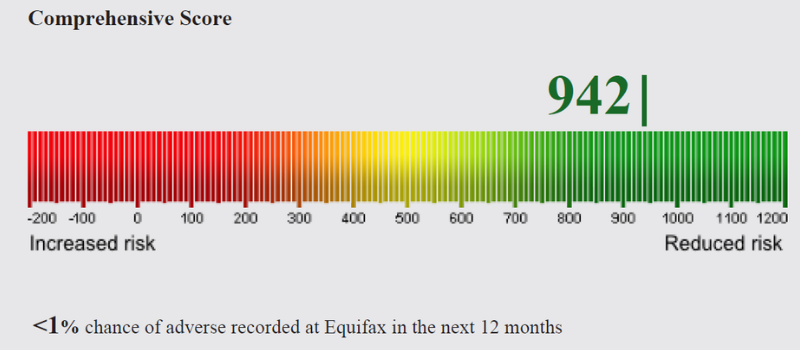

The Difference Between a Credit Score and Credit Report

If you’ve applied for or used credit, then you are likely to have a credit report and a credit score, referred to as your credit profile. It’s a way for Australian credit providers, such as banks and credit card companies, to help work out how likely it is you’ll be able to repay a loan.

5 Things to Know Before Buying Your First Home

Buying a house is one of the biggest achievements and scariest things you’ll ever do. It can also be a very exciting time, however there are a few things you need to consider before you take the homeowner plunge.

Federal Budget Overview

On 2 April 2019, the Government handed down the 2019-20 Federal Budget. The focus of the Budget is for a stronger economy and securing a better future.

The changes proposed in this year’s Budget are minimal in number compared to prior years, and largely positive, which is no surprise in an election year.

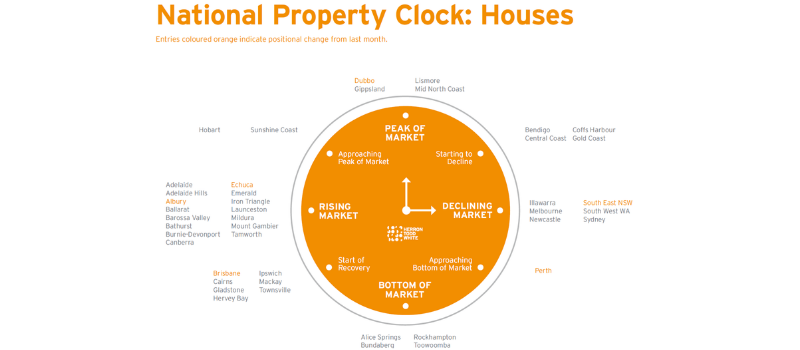

Buying or Selling? Review the March Property Clock

If you’re looking to buy or sell, the Herron Todd White (HTW) Residential Property Report is a great reference tool. Their property clock is a good visual representation of the state of the property market and its cycles. The March national property clocks for houses and units are included below, along with detail on how it works and to best use it.

Current Issues Faced by Small Business Accessing Finance

Many small businesses looking to grow find it hard to access finance. Lenders say that they are keen to lend to small businesses, but that unsecured finance involves more risk. This article outlines some initiatives that could help to improve access to finance for small businesses. Issues with Obtaining Finance as a Small Business The proportion of small businesses that …

Property Investors Hit Hard by Falling Prices and Tighter Credit

Investors are big players in Australia’s property market, representing about 42 per cent of total mortgage demand. In the days of the property boom, they reigned supreme with their superior purchasing power. They had willing banks and favourable tax laws working for them, increasing property prices and capital gains. However, the banks’ tighter lending policies in the wake of the …

Summary of the Key Findings of the Banking Royal Commission Final Report

This month, the findings of the damning final report from the Banking Royal Commission into the financial services industry were handed down. High Court justice and royal commissioner Kenneth Hayne unveiled 76 recommendations for key aspects of the banking, superannuation, financial advice, and the rural lending industries. While the final report totals 530 pages, a quick summary of the recommendations …