If you’ve applied for or used credit, then you are likely to have a credit report and a credit score, referred to as your credit profile. It’s a way for Australian credit providers, such as banks and credit card companies, to help work out how likely it is you’ll be able to repay a loan.

Your credit report and score are pieces of information that can be used by credit providers to help decide whether or not you will receive credit you apply for and also contribute to the terms on which you receive the credit.

What is a Credit Report?

A credit report is a record of your credit history, collected from a number of different sources, including:

- Credit providers:Credit unions, banks, payday lenders, store credit issuers, phone and utility providers.

- Public record information: Australian Securities and Investments Commission (ASIC) records, Judiciary records (court writs and judgements relating to credit), bankruptcy and debt agreement information.

There are a number of components to a credit report, including:

- Personal information such as your name, gender, date of birth, driver’s licence number, address and employment history.

- The number of credit enquiries, or applications, you’ve made.

- Any proprietorships or directorships you have.

- Any overdue accounts.

- Details about credit accounts you may hold, including the provider, account type, opening date, closing date, credit limit.

- Repayment history such as whether you meet your repayments on time, any missed or late payments (this information won’t be provided by phone and utility providers).

- Debts of $150 or more that were not paid within 60 days.

The details in your credit report are regulated by the Privacy Act 1988, to balance the need to respect your privacy with the need to ensure credit providers have the information to grant credit to consumers. You can access your credit report for free each year. To change incorrect information in your credit report, approach the credit reporting body directly or you can go to the Equifax Corrections Portal.

What is a Credit Score?

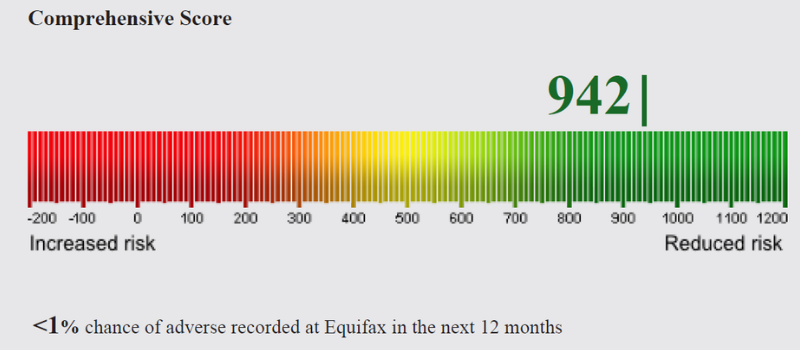

In contrast to the credit report, that contains detailed information about your credit history in writing, the credit score is a numerical figure. The Equifax Score uses the information from your report at a point in time and turns this into a number between 0 and 1,200.

Two people could have the same credit score, but this does not mean the information within their credit report is identical as there are many factors that contribute to a credit score.

The Equifax Score uses a comprehensive credit scoring model to display it as both a number and a percentage range that puts you within a range of other credit-active Australians:

- Below average (bottom 20 per cent)

- Average (21-40 per cent)

- Good (41-60 per cent)

- Very good (61-80 per cent)

- Excellent (81-100 per cent)

If you have a below average or average Equifax Score, you are more likely to have adverse information recorded and if your Equifax Score is good, very good or excellent, Equifax predicts you are less likely compared to the average credit-active Australian.

Why is it Important to Know Your Credit Profile?

As your credit profile includes a credit score and credit report generated using data from your credit history, it’s important to keep track of changes to your credit report and credit score, because you can potentially improve these. This is particularly vital if you’re planning to apply for a large amount of credit soon, such as a home loan. Changes to your credit profile could also indicate that incorrect information has been entered, in which case you’ll be alerted quickly and be able to act.

Find Out More About Your Credit Profile

To discover more about your credit score and credit report, you can take a look at Equifax’s free credit report and annual subscription packages. Your credit profile is unique, and must take into account your personal objectives, financial situation or needs. Contact me directly if you would like to discuss your individual circumstances further.